Ira withdrawal tax rate calculator

If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a. The 10 penalty can be waived however if you meet one of eight exceptions to the early-withdrawal penalty tax.

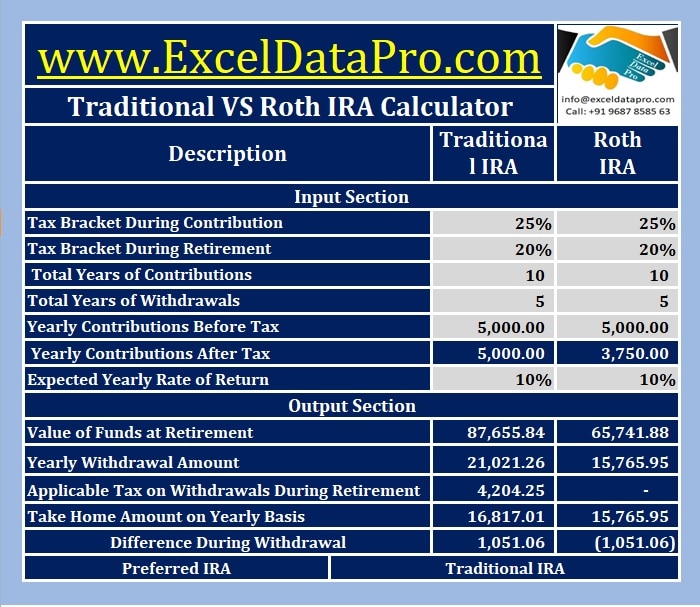

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus.

. If you made withdrawals from any IRA qualified retirement plan or other tax-advantaged account and owe a 10 early withdrawal penalty or other penalty enter the penalty amount here. Youll pay income taxes and a 10 penalty tax on earnings you withdraw as of 2022. If you withdraw money before age 59½ you will have to pay income tax and even a 10 penalty.

The IRA Withdrawal Calculator which has been updated to conform to the SECURE Act of 2019 will calculate your current minimum required withdrawal and then forecast your future required withdrawals if you are an IRA owner age 70-12 or older or. That said Roth IRA accounts have historically delivered between 7 and 10 average annual returns. Exceptions to the Early Withdrawal Penalty.

IRA is a tax-savings account targeted to grow your retirement savings. Your household income location filing status and number of personal exemptions. A fixed-rate IRA CD provides that certainty.

In certain hardship situations the IRS lets you take withdrawals before age 59 12 without a penalty. The most common. If the contribution limit remains 6000 per year for those under 50 youd amass 83095 assuming a 7 growth rate after 10 years.

Applies to personal accounts only. Under normal circumstances you cannot withdraw money from your traditional individual retirement account IRA without facing a penalty tax until you reach age 595. Yes you can withdraw more than the RMD from your IRAs without IRS penalty.

Please see Form 5329 Additional Taxes on Qualified Plans. The ira calculator exactly as you see it above is 100 free for you to use. Tax-free and penalty-free withdrawal on earnings can occur after the.

A hardship withdrawal allows the owner of a 401k plan or a similar retirement plan such as a 403b to withdraw money from the account to meet a dire financial need. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401k or 403b plans among others can create a sizable tax obligation. First to avoid both income taxes and the 10 early withdrawal penalty you must have held a Roth IRA for at least five years.

If you return the cash to your IRA within 3 years you will not owe the tax payment. The IRS typically allows this when you need the money to cover certain expenses like substantial medical bills or education. Can I take more than the minimum IRA withdrawal after age 59 ½.

Calculating Income Tax Rate. You can however avoid this sanction if you make an IRA hardship withdrawal. Aside from paying your regular income tax rate you can take withdrawals once you reach age 595 without incurring the 10 early distribution penalty.

Best and worst states for retirement. While you still have to pay taxes on any money taken out of a 401k or IRA before a certain age there are some circumstances that would let you get around the 10 early withdrawal penalty for retirement funds. Enter the marginal tax rate you anticipate to have at retirement.

You can use the Traditional IRA calculator if youve inherited an IRA from a spouse. You havent met the five-year rule but youre over age 59 12. You can make a penalty-free withdrawal at any time during this period but if you had contributed pre-tax dollars to your Traditional IRA remember that your deductible contributions and earnings including dividends interest and capital gains will be taxed as ordinary income.

Best age to take Social Security. You may incur an early withdrawal penalty from your bank and a 10 percent early withdrawal tax. Lets say you open a Roth IRA and contribute the maximum amount each year.

If you are under 59 12 you may also be subject to a 10 early withdrawal penalty. How to avoid early withdrawals. Only Roth IRAs offer tax-free withdrawals.

Traditional SIMPLE or SEP IRA. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Once you reach age 59½ you can withdraw funds from your Traditional IRA without restrictions or penalties.

Contributions to an IRA moving expenses and health-insurance contributions for self-employed persons. This condition is satisfied if five years have passed since you first. Minimum opening balance is 2500.

A penalty may be charged for early withdrawal. But sometimes early distributions are tax free and penalty free. Use this calculator to see what your net withdrawal would be after taxes and penalties are taken into account.

The Early Distribution Penalty The real issue with traditional IRA withdrawals occurs when theyre taken before age 595. We will send you written confirmation of the interest rate APY and maturity date of your IRA CD after it is opened or funded. Exceptions for Both 401k and IRA.

It is important to note that the early withdrawal penalty is 25 for SIMPLE IRAs which is much. The income tax was paid when the money was deposited. Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years.

The total amount of your RMD is generally taxed as ordinary income at your personal federal income tax rate. The IRA calculator can be used to evaluate and compare Traditional IRAs SEP IRAs SIMPLE IRAs Roth IRAs and regular taxable savings. Balance at Age 65.

Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly. This adjustable-rate mortgage calculator helps you to approximate your. Early withdrawals from an IRA trigger taxes and a 10 penalty.

Marginal Tax Rate in Retirement. You havent met the five-year rule for opening the Roth and youre under age 59 12. 401K and other retirement plans.

Traditional IRA calculator. You die or become permanently disabled.

Download Roth Ira Calculator Excel Template Exceldatapro

Traditional Vs Roth Ira Calculator

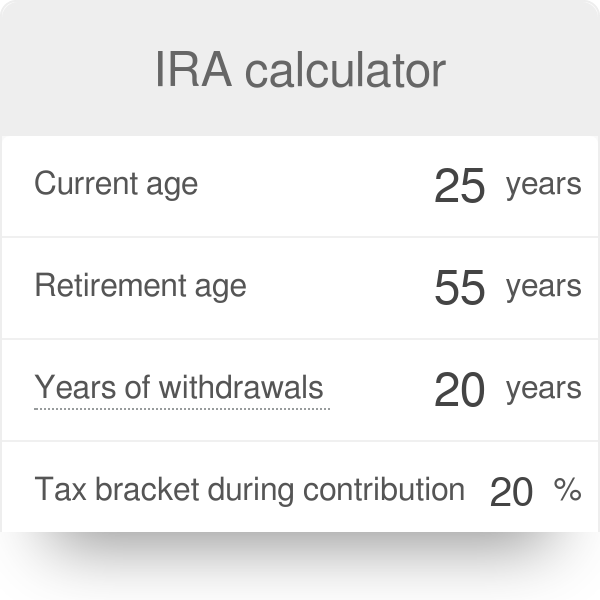

Ira Calculator

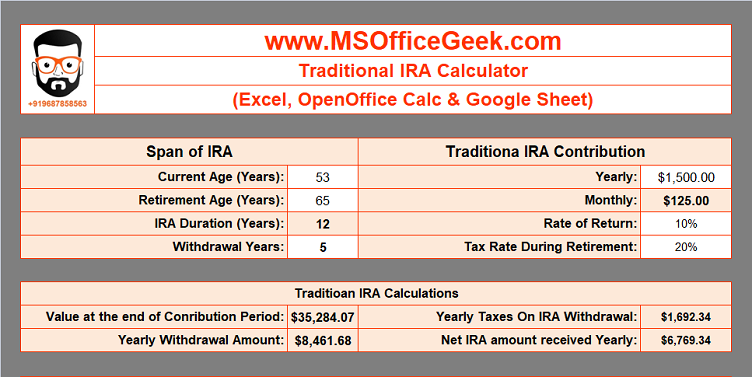

Download Free Traditional Ira Calculator In Excel

Roth Ira Calculator Roth Ira Contribution

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Traditional Ira Calculator Excel Template Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Traditional Vs Roth Ira Calculator

Retirement Withdrawal Calculator For Excel

Ready To Use Traditional Ira Calculator 2021 Msofficegeek

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Traditional Roth Iras Withdrawal Rules Penalties H R Block

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Ready To Use Traditional Ira Calculator 2021 Msofficegeek

Ready To Use Traditional Ira Calculator 2021 Msofficegeek

Download Traditional Ira Calculator Excel Template Exceldatapro